The higher Sharpe ratio, the smoother the equity curve. Thus, this formula yields a value that could be loosely defined as return per unit risked if we accept the premise that variability is risk. Can be changed with the "risk_free_rate" parameter of the "strategy()" function). The formula for the Sharpe ratio is SR = (MR - RFR) / SD, where MR is the average return for a period (monthly for a trading period of 3 or more months or daily for a trading period of 3 or more days), and RFR is the risk-free rate of return (by default, 2% annually.

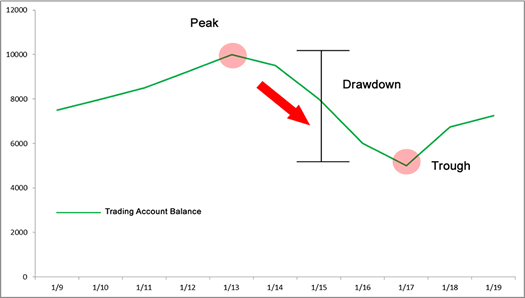

The Sharpe Ratio is widely used by portfolio managers and individual traders to show how much risk was taken to achieve specific returns. Nobel Laureate, William Sharpe, introduced the Sharpe Ratio in 1966 under the name “reward-to-variability ratio”.This is the return achieved if all funds (initial capital) were used to buy this security when you first enter a trade, and then held it until your test period was over.the greatest possible loss the strategy had during its run compared to its highest profits.

Displays the greatest loss drawdown, i.e.The total amount of money that you have lost on all your losing trades.The total profit for all trades generated by a strategy.The value shown is the total amount earned or spent, considering whether it's positive or negative based on sign of trade(s). An investors profits/losses in real time.The percentage might not seem very informative at first, but if we take into account what type or magnitude an increase/decrease in profit could have on our overall portfolio then things become much clearer

This can be calculated by dividing your number of winning trades over all the ones made during that time period and multiplying this result with 100%. The percent profitable metric is a measure of how likely it is that you will win money when trading.

0 kommentar(er)

0 kommentar(er)